🥶 Cooling Cringe: Why I Can't Stand This Phrase

Parched while pining for random drips descending from corporate A/C units in the sky

I don’t know why this economic term bothers me so much: cooling. As in, “cooling inflation” or “interest rates cool.”

Or here, in an explanation of how The Federal Reserve works—a private institution, btw, as brilliantly outlined in The Creature of Jekyll Island1—it is mentioned twice in the same sentence:

The Fed has two official goals: Central bankers are supposed to control inflation and maintain a strong labor market. That means that when inflation is rapid, as it was from 2021 to 2023, officials lift interest rates to slow the economy and wrestle it down. And when inflation cools, as it has been recently, policymakers lower interest rates to make sure that they do not cool growth so much that they risk serious damage to hiring conditions.

Is it because we see inflation as a binary gauge for the economy, only ever cooling or heating? Do we have no other verbs for this phenomenon? How about moderating, stabilizing, softening, slowing, or leveling?

I never noticed or cared much about the term cooling until last year, when it started making me cringe alongside “soft landing.” Suddenly when reading, a visceral anger would wash over. But why?

Maybe it’s because the headlines are crying wolf somehow; you, dear little consumer (I hate that word too), should be feeling better soon, because interest rates are cooling. Or you should be able to afford your groceries because inflation has cooled. Why aren’t you happier? Why are you still in the red, emotionally and financially?

Last September, I wrote to for her This is Not Advice column on , and she graciously answered my question about why, when the headlines seemed so positive, I was still feeling so pinched. My original question:

The majority of people I talk to, particularly small business owners who are friends or clients, are experiencing one of their slowest/hardest/most grueling years of the decade—if they are even still in business.

Maybe it’s just my circles? Or slow work combined with exhaustion? Summer slump? Do employees and large employers have a recession-free-seeming existence while only small business owners are feeling it? Even the employees I speak with seem afraid to make moves, and equally afraid to get laid off. So where is the mainstream optimism coming from??

Tara’s response is a must-read if you, too, are tired of these glowing headlines while still feeling financially horrible, the equivalent of a long cold whose symptoms won’t abate. This part of her reply was particularly illuminating:

It’s important to note that businesses don’t benefit from "improvements" in the economy in the same way. I've previously argued that small business owners and independent workers have more in common with workers than they do with corporations.

So, while large corporations are doing just fine (even seeing record profits), it follows that the small business owners and independent workers Jenny talks to are feeling the squeeze.

The reason this feels like a hard, even grueling year for small business owners is because, after a short respite, traditional workers are suffering from the same bullshit they were pre-pandemic . . . and most of us don’t have access to a public safety net as traditional workers do. Nor do we have reserve cash to tap into or massive expense budgets we can tighten as corporations do.

Is it that those with full-time professional-managerial class (PMC) jobs can’t understand why the rest of us outside of the official GDP and traditional “labor market” are struggling?2

My personal confidence took a huge hit when the pandemic wiped out the momentum I was building in my business (admittedly buoyed by the luck of paralleling economic boom times). Official consumer confidence index measures are still struggling to rebound fully, too.

Just this week, The New York Times ran several headlines addressing this knowing-feeling gap:

The Fed’s Preferred Inflation Gauge Cooled Overall in September

Jobs Data Come as the Fed Stares Down a Complex Moment; subheading—here’s that damn word again!—“Growth has been resilient, but inflation is cooling. The combination makes it hard to guess how much policymakers will lower rates.”

Why Cooling Inflation Hasn’t Eased Sticker Shock, with a smug version of the headline for the online edition, “When the Price of Your Burrito Clashes With Your ‘Reference Price’” (Our burrito?! Please.)

Inflation Is Basically Back to Normal. Why Do Voters Still Feel Blah? This one also employs the vaguely condescending subheading, “Consumers still give the economy poor marks, though the job market is strong and price increases have faded for months.”

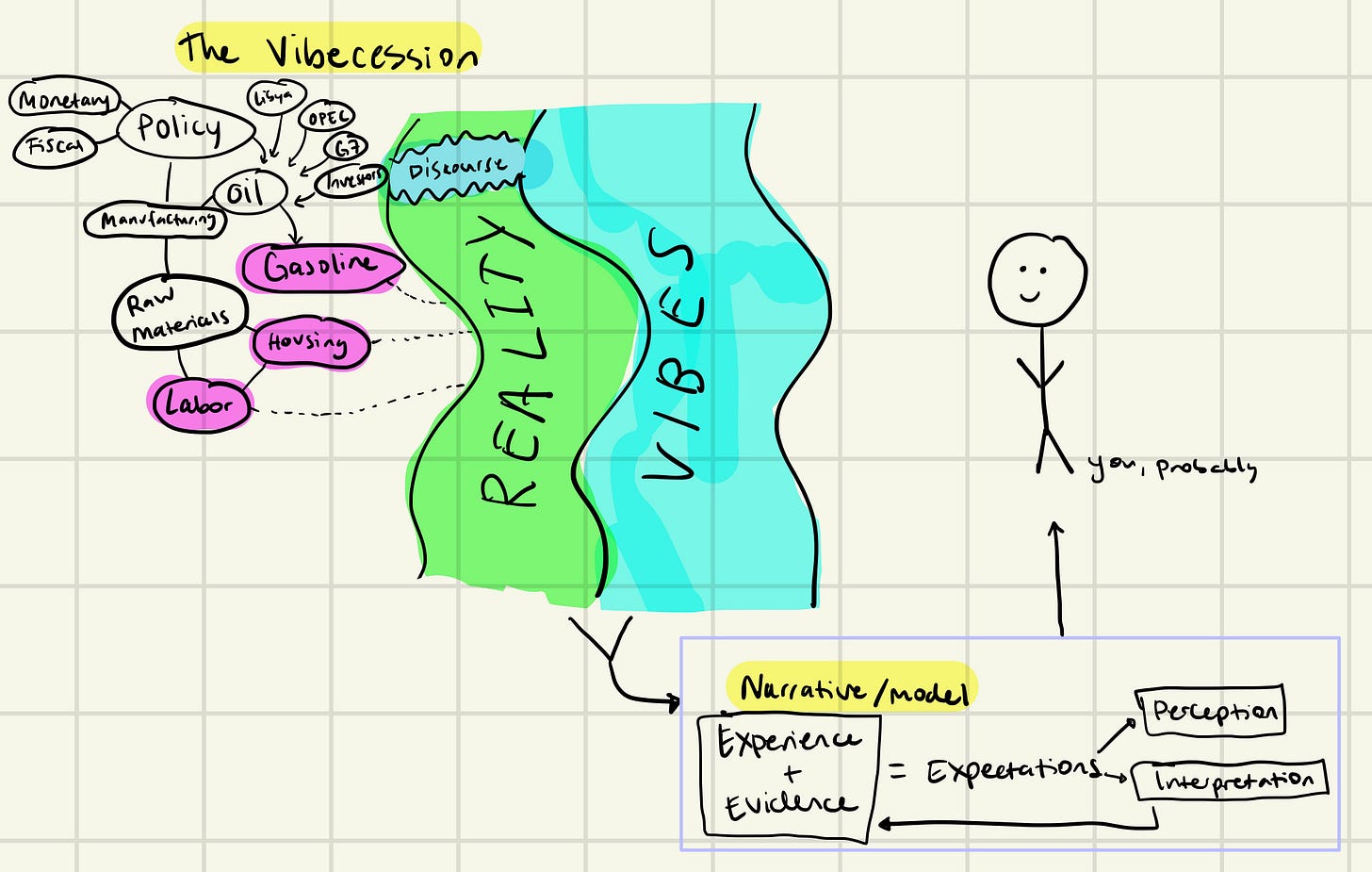

Even Kyla Scanlon’s term, vibecession—coined in June 2022 and later expanded into a book called In This Economy?—implies on some level (even if only at first glance) that we’re only feeling vibes, not an actual material pinch (try anvil or albatross). Wikipedia summarizes her phrase as “a disconnect between the economy of a country and the general public's negative perception of it.”

Many of the same business owners I spoke with last summer who were struggling then have even more precarious client pipelines now.

Perhaps my frustration is that, despite optimistic headlines, those of us who rely on bigger fish for part of our income—larger companies who benefit from and embrace (and eventually spend more) when interest rates are lower—must wait much longer for the cool to reach us, parched as we pine for random drips falling off the great corporate A/C units in the sky.

It is increasingly common for me to hear about entrepreneurial friends with rising credit card debt and interest (which I also hold), or who have taken out loans ranging from tens of thousands to hundreds of thousands and even into the millions of dollars to maintain a life-saving pulse on their businesses.

The venture capital industry runs on debt—the whole American economy does—yet it can be crushing for those of us who prefer to “bootstrap” and stay ahead of our bills, given that we aren’t likely facing a large exit down the road to magically wave away the growing pile of IOUs.

When Doh started in the summer of 2023, I shared the phrase “survive ‘til 25,” borrowed from the real estate industry. I was secretly hoping we wouldn’t need it for that long. But alas, here we are, facing a presidential election in four days that may produce aftershocks of uncertainty and upheaval for weeks or months afterward, thus keeping even more spending money on the sidelines.3

“If you can just make it through the next sixty days without selling the last of your stock,” my accountant told me this week, “we can avoid the capital gains tax bill and try to get things back on track.”

Can I? Here’s hoping. I always told myself that when I sold that final tranche of Google stock, the last of my reserves earned by my former PMC self, it would be time to give up on my business and/or New York City.

It’s getting hotter in here. So can we please find another effing word for cooling?!4

❤️

From the book’s colorful description:

Where does money come from? Where does it go? Who makes it? The money magicians' secrets are unveiled. We get a close look at their mirrors and smoke machines, their pulleys, cogs, and wheels that create the grand illusion called money. A dry and boring subject? Just wait! You'll be hooked in five minutes. Reads like a detective story - which it really is.

See also: Catherine Liu’s book, Virtue Hoarders: The Case Against the Professional Managerial Class. She also gives an overview in this interview with :

From The New York Times article, “Uncertainty Over Election Stirs Anxiety On Wall Street” (emphasis mine):

Ralph L. Schlosstein, chairman emeritus of the investment bank Evercore and a prominent figure on Wall Street for half a century, said he could scarcely remember a period of deeper financial paralysis. “What’s missing,” he said, “is real confidence about the future.”

“Right now, we have both economic and political uncertainty,” he added. There’s more than just confidence at stake. Action is currency on Wall Street — where investment bankers collect fees at the completion of transactions — and this is turning out to be a particularly insipid stretch.

In the first nine months of 2024, $558 billion worth of corporate deals were completed, the lowest total since 2003, according to the data provider Dealogic.

If you enjoyed this post, you might also appreciate:

🤬 Rant From the Wound: Why This Platitude Meme Engraged Me*

“Anyone who has created a work of art knows how it feels to travel to another realm, to leave the world behind and enter a place apart. The artist exists there, poised and sometimes barely breathing, in a state of heightened awareness that is as thrilling as it is excruciating.

Hi Jenny,

I'm a new subscriber (from Australia), but I want you to know I really appreciate your honest writing and refreshing ideas. I hope you can continue to keep working for yourself and writing, because I love your work (it's so original!).

Speaking of cringe-factor, until I read your book Free Time (because Cal Newport plugged you in his book Slow Productivity) I would cringe at the advice written in most business books and courses. I thought maybe I wasn't a 'business type' person because I cared more about people, community, my health and the environment more than making a quick buck. But reading your books has shifted my thinking in a dramatic and profound way.

I work as a public speaker and I lost a lot of clients due to my decision to stop doing in-person speaking jobs in schools. Speaking to hundreds of students in poorly ventilated spaces was not aligned with my value of health (I don't want to get covid and long covid). Sometimes I miss the in-person jobs but I am finding joy in new ways of working and rediscovering parts of myself that aren't connected with making money (e.g., cooking and hiking). What I'm trying to say is your books Free Time and Pivot have helped me to readjust and get through a very difficult period. Thank you Jenny.

Take care,

Jane